How do I get financing for my Project

When it comes to financing your project, it's essential to conduct thorough research to explore all your options. Traditional lending institutions, such as banks, may offer project financing with competitive terms and interest rates. However, don't overlook alternative methods like crowdfunding, which can provide access to a wider pool of potential investors. By researching different financing options, you can make an informed decision that suits your project's specific needs and goals.

Researching traditional lending institutions for project financing

When seeking project financing, it is important to research traditional lending institutions such as banks. These institutions have experience in providing loans for various projects and offer competitive terms and interest rates. By exploring and evaluating multiple lenders, individuals can find the best fit for their project and increase their chances of approval. Additionally, understanding the lending criteria, terms, and reputation of these institutions can help borrowers make informed decisions. [1]

Exploring alternative financing methods like crowdfunding

Crowdfunding is an increasingly popular alternative financing method for project funding. With platforms like Kickstarter and GoFundMe, individuals can create campaigns and attract backers who contribute money towards their project. Crowdfunding allows for a wide reach and can generate significant funding, especially if the project has a compelling pitch and resonates with the public. However, it's important to carefully plan and market the campaign to maximize its success. [4]

Understanding the Financing Process

The financing process involves understanding the application and approval process for project financing. It is important to research and gather all the necessary documentation and requirements needed for financing. This includes submitting a detailed project proposal, financial statements, and credit history. Once the application is submitted, potential lenders will review the information and make a decision based on their criteria. It is crucial to be prepared and knowledgeable about the process to increase the chances of securing project financing. [5]

Understanding the application and approval process for project financing

The application and approval process for project financing can be complex and time-consuming. It typically involves submitting a detailed project proposal, financial statements, and credit history to potential lenders. These lenders will review the information and assess the viability of the project, including factors such as the business model, market conditions, and potential risks. They will also consider the applicant's credibility and financial stability. If the lender determines that the project is feasible and the applicant is creditworthy, they may approve the financing request. However, it is important to note that approval is not guaranteed and lenders may impose certain conditions or require additional documentation before finalizing the financing agreement. To navigate this process successfully, applicants should be prepared, organized, and knowledgeable about the specific requirements of each lender.

Learning about the documentation and requirements needed for financing

When seeking financing for a project, it is essential to understand the documentation and requirements needed by lenders. Each lender may have different criteria, but common documents requested include a detailed project proposal, financial statements, credit history, and a business plan. Additionally, lenders may require collateral, proof of insurance, or personal guarantees. By familiarizing yourself with these requirements, you can streamline the application process and increase your chances of securing financing.

Securing Project Financing

Securing project financing is a crucial step in turning your project into a reality. By securing a business loan, you can access the necessary funds to fund your project's development and growth. It is essential to carefully research and choose the right lender that aligns with your project's needs and financial requirements. And don't forget to negotiate the terms and conditions to ensure favorable terms for your project's success.

Securing a business loan for your project

Securing a business loan for your project is an important step in funding its development. To secure a loan, you will need to approach banks or financial institutions with a well-prepared business plan, financial projections, and collateral if required. It's crucial to demonstrate the potential for profitability and provide concrete details of how the loan will be used to benefit your project. By presenting a strong case, you increase your chances of securing the necessary financing for your project's success.

Negotiating terms and conditions with potential lenders

When securing project financing, negotiating favorable terms and conditions with potential lenders is crucial. This involves open communication, clearly stating your financial needs and goals, and discussing things like interest rates, repayment terms, and any collateral requirements. By demonstrating your project's viability and presenting a well-prepared financial plan, you can increase your chances of securing favorable terms that meet your needs and set your project up for success. Visit [15] and [16] to learn more about negotiating terms and conditions with potential lenders.

Managing Project Finances

Managing project finances is a crucial aspect of successfully completing a project. It involves creating a budget and financial plan, tracking expenses, and ensuring financial stability throughout the project's duration. By using tools like project management software and financial tracking spreadsheets, project managers can effectively manage costs, allocate resources, and make informed financial decisions. This helps to stay within budget, maximize project profitability, and deliver a successful project outcome.

Creating a budget and financial plan for your project

One of the crucial steps in managing project finances is creating a budget and financial plan. This involves estimating the costs involved in executing the project, including labor, materials, equipment, and any other expenses. A detailed budget allows for better financial management and helps in tracking expenses throughout the project. It also helps in identifying areas where cost savings can be made and ensures that the project stays on track financially.

Tracking expenses and ensuring financial stability throughout the project

Tracking expenses and maintaining financial stability are critical aspects of managing a project. By consistently monitoring expenses and comparing them against the allocated budget, project managers can identify any discrepancies or potential issues that may arise. This helps in making necessary adjustments or cost-saving measures to ensure the project stays on track financially. Regular financial reports and updates also provide stakeholders with transparency and assurance that resources are being utilized efficiently. Through effective expense tracking, project managers can mitigate financial risks and maintain financial stability throughout the project duration.

Tips for Successful Project Financing

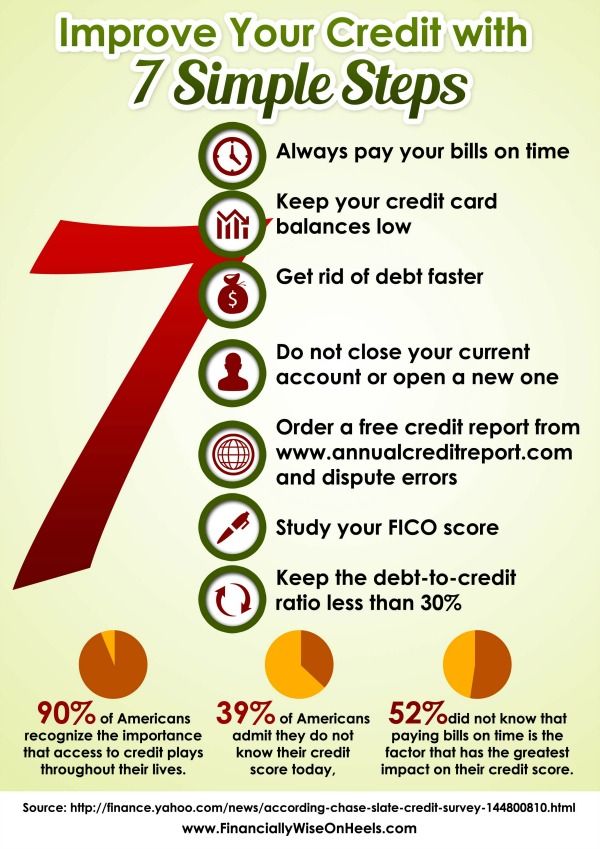

To ensure successful project financing, it is important to improve your credit score before applying for financing. This can be done by paying bills on time and reducing existing debt. Additionally, it is crucial to avoid common mistakes in the financing process, such as not thoroughly researching lenders or neglecting to create a comprehensive financial plan. By following these tips, you can increase your chances of securing the necessary funding for your project. For more assistance and guidance, consult resources available through financial institutions and government agencies. [24]

Tips for improving your credit score before applying for financing

Before applying for financing, it is important to improve your credit score. Start by paying bills on time and reducing existing debt. Keep your credit card balances low and avoid opening new credit accounts. Regularly check your credit report for any errors and dispute them if necessary. Finally, be patient, as improving your credit score takes time and discipline. Taking these steps will increase your chances of securing favorable financing terms.

Avoiding common mistakes in the project financing process

When it comes to project financing, it is crucial to avoid common mistakes that can hinder your success. One common mistake is not researching the different financing options available, which can result in choosing an ill-suited method for your project. Additionally, failing to understand the terms and conditions of your loan can lead to financial problems down the line. By taking the time to thoroughly research and understand your financing options, you can make informed decisions and increase your chances of securing successful project financing.

In conclusion, securing project financing requires thorough research, understanding the financing process, and careful management of project finances. By exploring various financing options, understanding the application and approval process, and creating a financial plan, individuals can increase their chances of securing funding for their projects. It is important to avoid common mistakes and seek guidance when needed. With the right approach, project financing can be successfully obtained, allowing individuals to bring their visions to fruition.

Summary of key points in project financing

Project financing involves researching financing options, such as traditional lending institutions and alternative methods like crowdfunding. Understanding the financing process includes familiarizing oneself with the application and approval process, as well as the required documentation. Securing project financing involves securing a business loan and negotiating terms with lenders. Managing project finances requires creating a budget, tracking expenses, and ensuring financial stability. Tips for successful project financing include improving credit scores and avoiding common mistakes. In conclusion, thorough research, understanding the process, and careful management are essential in securing project financing.

Resources for further assistance and guidance

:max_bytes(150000):strip_icc()/personalfinance_definition_final_0915-Final-977bed881e134785b4e75338d86dd463.jpg)

There are several resources available to provide further assistance and guidance in securing project financing. One option is to consult with financial advisors or professionals who specialize in project financing. They can offer expert advice and help navigate the complex process. Additionally, there are online platforms and communities that provide valuable insights and support for entrepreneurs seeking project financing. It's important to leverage these resources to increase your chances of success in financing your project.